China's Evolving Stroller Market: Competition, Trends, and Innovations

5.22.2025, 1:41:05 PM

5.22.2025, 1:41:05 PM

1082

1082

Home /Media Center / Press Release / China's Evolving Stroller Market: Competition, Trends, and Innovations

5.22.2025, 1:41:05 PM

5.22.2025, 1:41:05 PM

1082

1082

Influenced by upgrading consumer demands and new parenting approaches, retail sales of children's strollers in 2024 reached 16.98 billion yuan (2.36 billion USD), a 17.5% year-on-year increase, according to the 2025 China Toy and Juvenile Products Industry Report by the China Toy and Juvenile Products Association.

International Leaders vs. Chinese Challengers

International leaders like STOKKE, Bugaboo, and UPPAbaby continue to dominate the high-end market with strong R&D capabilities and premium branding. Notably, Bugaboo Fox5 Renew, priced over 10,000 yuan (1,372.40 USD), remains highly sought-after for its unique design, flexible handling, and multifunctional use.

Chinese brands are advancing to change the competitive market. Goodbaby continues to lead the domestic market with quality control, innovation, and market coverage. Holding multiple patented technologies, its stroller models meet the diverse needs of consumers.

Specifically in the lower-end markets, Chinese brands such as Oneye, Baobaohao, Dearmom, Hagaday and Elittle offer cost-effective solutions, while high-end demand remains expanding, willing to pay higher prices for high-quality, stylish, and personalized products.

Shifting Consumer Needs: From Practicality to Emotional Value

Today's young parents, especially Generation Z, demand more than functionality.

Key purchasing factors now include:

1. Safety and Comfort: 70.8% of consumers prioritise safety and comfort, a particular emphasis on stability. In response, leading stroller brands are ramping up investment in safety R&D. From improved structural stability to enhanced braking systems and non-toxic materials, manufacturers are continually upgrading safety features to meet evolving consumer expectations and regulatory standards.

2. Scenario-specific Products: Parents are seeking strollers tailored to specific usage scenarios. This demand has given rise to a variety of niche categories—such as high-view strollers, twin strollers, and compact strollers.

For example, Kinderkraft's stroller has been purposefully designed for outings. Meanwhile, the Joie Finiti stroller features a seat height of 60 cm, giving children a more expansive view of their surroundings.

3. Aesthetic Requirement: Strollers with personalised and artistic designs are preferable on social occasions. This innovative product marketing enhances shopping experience, strengthen the interaction and engagement between the brand and consumers.

The 2025 Spring/Summer launch of Goodbaby features a carbon fibre frame and weighing just 8.2 kg. The stroller combines minimalist black-and-white styling with lightweight performance—winning the hearts of modern, style-conscious mothers.

The Dearmom stroller, inspired by the romantic style of French painter Jean-Auguste-Dominique Ingres, features a distinctive green tone. This artistic approach not only elevates the product's emotional appeal but also enhances its perceived value and market differentiation.

Retail Channel Transformation: From Offline Experiences to Online Influence

Retail channels are reshaping competition in China's stroller market:

1. Offline Experience Optimization

Retailers are innovating to enhance the in-store experience. UPPAbaby has partnered with physical retail stores to introduce "stroller maintenance" service. This allows parents to interact with the product, reinforcing brand recognition, trust, and loyalty.

2. Online Content Marketing

Content-driven marketing has become a decisive factor in purchasing behaviour. 77% of stroller purchase decisions now begin with user reviews on social media. Tiktok feedback and Rednote recommendations are among top influences on consumer decisions. Related review hashtags and topics are gathering over 1 billion view in total, highlighting the strong influence of digital content in the market shift.

The Oneye T6 stroller harnessed the viral power of digital content by collaborating with well-known parenting influencers and content creators. Through detailed, professional review videos, the brand generated strong engagement and widespread consumer interest. According to Oneye official Tmall flagship data, this model has sold over 100,000 units, while its compact T2 version has surpassed 80,000 units, reflecting the power of social media-driven marketing in driving sales.

The Future Is Smart: When Strollers Go High-Tech

The stroller industry is embracing cutting-edge technologies like 5G connectivity, AI interaction, and new energy solutions. These innovations reshape stroller design to deliver smarter and seamless travel experiences for parents and babies.

A standout example is the I Believe 8S, which features intelligent tracking, obstacle avoidance, power assistance, remote control, and smart braking. Everything is designed for worry-free experiences.

Faced with declining birth rates and rising consumer expectations, brands that can identify niche demands, own tech edge, and prioritize sustainability will be best positioned to lead the next phase of growth. Looking ahead, smart features and personalised design will become the key drivers of industry evolution, delivering high-quality, high-value stroller solutions that resonate with the next generation of parents.

Get the First Look at Best-Selling Baby Products: A MUST-ATTEND Kids Fair for Buyers Worldwide!

China Kids Fair (CKE) has always been a vital bridge connecting brands and distributors, offering a key platform for channel partners to discover new products, gain insights into market trends, and expand business horizons. Every year, many high-quality juvenile brands showcase their innovative products.

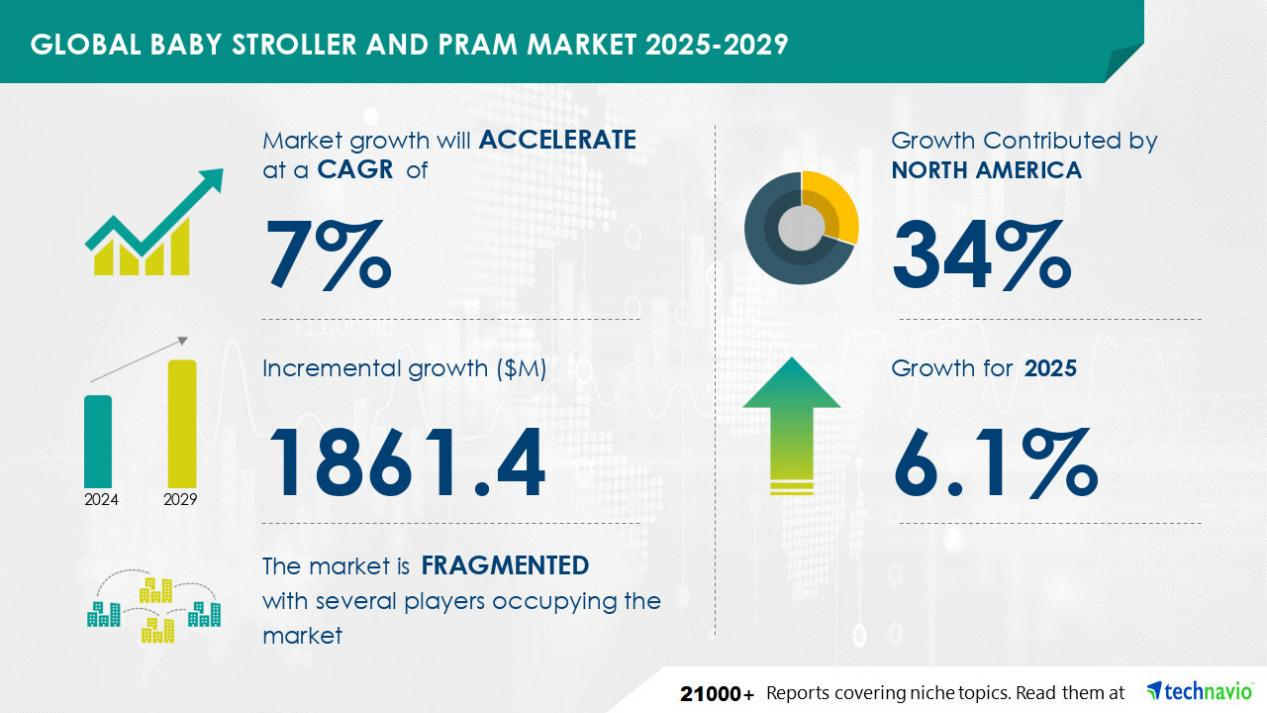

Global Baby Stroller Market Poised for $1.86B Expansion by 2029, Report Says

The global baby stroller and pram market is projected to grow by $1.86 billion between 2025 and 2029, driven by urbanization, nuclear family trends, and AI integration, according to a report published by Technavio. The sector is expected to register a compound annual growth rate (CAGR) exceeding 7%, reflecting evolving consumer demands and technological advancements.

Baby Carriers, Waist Stools Saw 105% Sales Surge on China's Tmall in February

According to the sales data for baby and children's products on China's e-commerce platform Tmall in February, there was a year-on-year increase in sales across 9 major product categories: children's bicycles, electric ride-on cars, scooters, children's four-wheeled strollers, baby bottles, children's car seats, high chairs, playpens, and baby carriers/waist stools. The top 3 categories with the highest sales growth were baby carriers/waist stools (105.1%), playpens (62.4%), and high chairs (52.9%).

Precision Matchmaking: Hanchuan Strollers Impress Global Buyers

Global demand for infant and child products continues to rise, with baby strollers as an essential category, maintaining a high compound annual growth rate. As a major industrial cluster for baby strollers in China, Hanchuan has a complete supply chain system and mature manufacturing expertise. To facilitate precise connections between Hanchuan stroller enterprises and global buyers, the "the 37th CTJPA Global Business Matching - Hanchuan Special", organized by the China Toy & Juvenile Products Association (CTJPA), was successfully held on June 19th.