Children’s Car Seat Sales in China Surge 64.6% Amid Broader Juvenile Product Growth

3.18.2025, 9:59:31 AM

3.18.2025, 9:59:31 AM

645

645

Home /Media Center / Press Release / Children’s Car Seat Sales in China Surge 64.6% Amid Broader Juvenile Product Growth

3.18.2025, 9:59:31 AM

3.18.2025, 9:59:31 AM

645

645

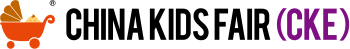

Data from the China Toy & Juvenile Products Association (CTJPA) shows year-on-year growth in seven juvenile product categories on China’s E-commerce platform Tmall, including strollers, bicycles, electric ride-on cars, car seats, high chairs, playpens and baby carriers. The top three are car seats (+64.6%), strollers (+23.6%) and bicycles (+14.4%).

Source: ECdataway. Chart: CKE

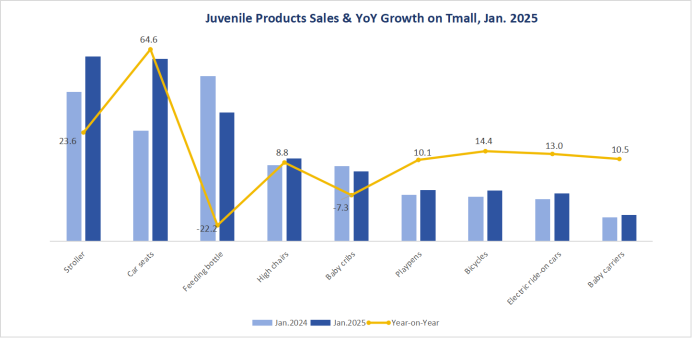

In terms of average price, all nine categories of juvenile products saw year-on-year increases. The top three are car seats (+41.6%), baby carriers (+34.2%), and high chairs (+24.4%).

Source: ECdataway. Chart: CKE

01

Upgraded equipment boosts children’s consumption demand for ride-on products

▋Bicycle sales rose 14.4%, with 40% growth from ¥700-¥1000 products

Children’s bicycle sales rose 14.4% year-on-year, with a 4.7% increase in units sold and a 9.2% rise in average price. The ¥700-¥1000 price range contributed 39.3% to sales growth, accounting for 16.2% of total sales, up 3.3%.

A top-seller is the MONTRESOR Breeze bicycle with an average of ¥801. It features a lightweight frame, dual brakes, enclosed chain guard, anti-slip pedals, and detachable training wheels for safety. The adjustable seat caters to children of different heights.

▋Electric ride-on car sales increased 13.0%, with 40% growth from ¥400-¥600 products

Electric ride-on car sales grew 13.0%, with a 4.2% rise in units and an 8.4% increase in average price. The ¥400-¥600 range contributed 55.8% to growth, while the ¥700-¥1000 range made up 20.0%, up 4.7%.

The J2077 Mercedes G-Class children’s electric car, priced at ¥567, offers remote control, rocking, and self-driving modes, with a built-in Bluetooth music module to enhance learning and curiosity.

02

The Spring Festival travel peak drives demand for high-quality and affordable baby products

▋Stroller sales rose 23.6%, with 50% growth from ¥900-¥1800 products

Stroller sales grew 23.6%, with a 1.5% rise in units and a 21.8% increase in average price. The ¥900-¥1800 range contributed 56.3% to growth and accounted for 27.1% of sales, up 6.9%.

The best-seller is the Newber 808A 2nd generation stroller (¥832). It features a lightweight aluminum frame, full-cover sunshade, breathable mesh for airflow, and 3D shock-absorbing wheels for stability and safety.

▋Car seats sales grew 64.6%, with 60% growth from ¥600-¥1800 products

Car seat sales grew 64.6%, with a 16.8% rise in units and a 41.6% increase in average price. The ¥600-¥1800 range contributed 66.9% to growth and accounted for 39.9% of sales, up 17.5%.

The best-seller is the BOBEITOO G409-ISO BeiYue car seat (¥1231). It features a car-grade steel frame, shock-absorbing materials, and a 175° reclining design, along with the breathable fabric, creating a secure and comfortable environment.

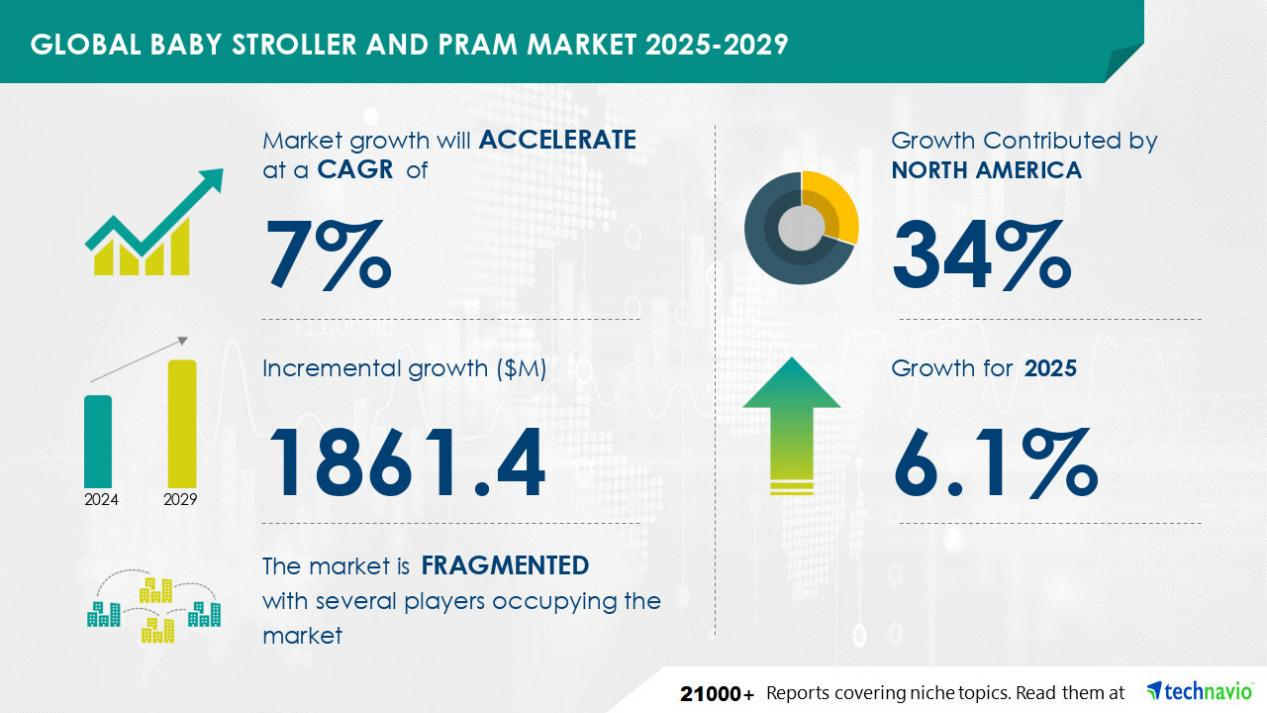

Global Baby Stroller Market Poised for $1.86B Expansion by 2029, Report Says

The global baby stroller and pram market is projected to grow by $1.86 billion between 2025 and 2029, driven by urbanization, nuclear family trends, and AI integration, according to a report published by Technavio. The sector is expected to register a compound annual growth rate (CAGR) exceeding 7%, reflecting evolving consumer demands and technological advancements.

CTJPA's 2024 Exhibitions Conclude with Success: A Showcase of Industry Trends and Global Partnerships

On October 18, 2024, China Toy Expo, China Licensing Expo, China Kids Fair, and China Preschool Expo concluded successfully at the Shanghai New International Expo Centre (SNIEC). Organized by China Toy & Juvenile Products Association (CTJPA), the event brought together 2,506 exhibitors from 36 countries and regions worldwide, along with 20 major production hubs for toys and baby products. The exhibition showcased 5,218 brands and over 2,400 global licensed IPs across an area of 230,000 square meters. It attracted a total of 111,458 professional attendees, including 9,086 international buyers. With 262 splendid activities, cross-industry creativity flourished, fully demonstrating the latest industry developments and resources. The event received widespread recognition from exhibitors and attendees.

Get the First Look at Best-Selling Baby Products: A MUST-ATTEND Kids Fair for Buyers Worldwide!

China Kids Fair (CKE) has always been a vital bridge connecting brands and distributors, offering a key platform for channel partners to discover new products, gain insights into market trends, and expand business horizons. Every year, many high-quality juvenile brands showcase their innovative products.

China's Evolving Stroller Market: Competition, Trends, and Innovations

Influenced by upgrading consumer demands and new parenting approaches, retail sales of children's strollers in 2024 reached 16.98 billion yuan (2.36 billion USD), a 17.5% year-on-year increase, according to the 2025 China Toy and Juvenile Products Industry Report by the China Toy and Juvenile Products Association.